Business insurance is a crucial component for protecting companies from unexpected financial losses and risks. It offers coverage for a wide range of potential threats, including property damage, liability claims, and employee injuries.

By investing in business insurance, organizations can safeguard their assets, ensuring stability and continuity even during challenging times. Liability coverage is particularly essential, as it helps protect a business from lawsuits or legal actions.

Additionally, commercial property insurance protects physical assets such as buildings and equipment from damage or loss. Ultimately, insurance policies are vital for mitigating financial risks, enabling businesses to focus on growth and innovation without the constant worry of unforeseen setbacks.

The Importance of Business Insurance for Your Business

Every business needs business protection to safeguard against unexpected challenges. Business insurance isn’t just a safety net—it’s an essential tool that helps keep your business running smoothly in the face of adversity. Liability coverage ensures that your business is protected from lawsuits. General liability insurance is especially important as it covers bodily injuries, property damage, and other common accidents that could otherwise bankrupt your business.

Without proper insurance, your business is vulnerable to severe financial losses. Accidents can happen at any time, and property insurance can protect your physical assets from damage caused by theft, fire, or weather-related disasters. Without it, a small setback could lead to the end of your business. Insurance can mean the difference between survival and closure.

Key Reasons Why Every Business Needs Insurance

There are several reasons why every business should have insurance. First, financial protection is crucial. Without it, one accident or lawsuit could drain your business savings. Second, insurance for business owners helps protect your employees. Workers’ compensation ensures that employees who are injured at work get medical care and compensation for lost wages. If you don’t have it, your business could face costly lawsuits or even be shut down.

Additionally, business continuity is vital. If something happens that halts your operations, business interruption insurance ensures that you can still cover essential costs like rent and payroll. Insurance helps businesses stay afloat during tough times and recover quickly.

When Should You Consider Getting Business Insurance?

The best time to get business insurance is as soon as you start your business. Many businesses think they can delay getting coverage, but this can be dangerous. As soon as you hire employees or make significant investments in equipment, your need for liability protection and property damage protection becomes crucial. Even a small mishap can lead to big financial losses.

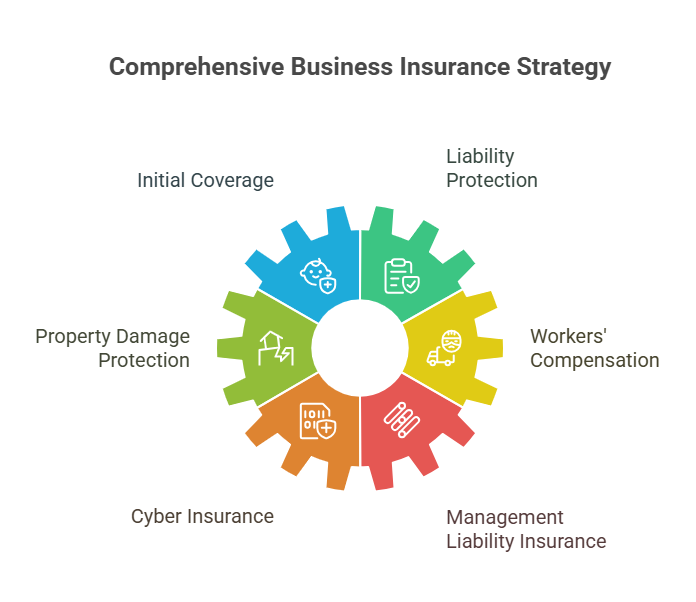

You should also reconsider your insurance coverage as your business grows. For example, workers’ compensation becomes necessary when you hire full-time employees. Similarly, as you expand, you may need more specialized coverage, like cyber insurance or management liability insurance to protect against data breaches or executive risks.

The Different Types of Business Insurance You Should Know About

There are various types of business insurance, each serving different needs. General liability insurance is essential for all businesses. It protects you from claims involving injuries or property damage caused by your business operations. For those with physical assets, property insurance is necessary. It covers damage to your building, equipment, or inventory. If your business deals with providing services, professional liability insurance is crucial to protect against lawsuits for errors or negligence in your services.

For businesses that rely on vehicles, commercial auto insurance is needed. And for those operating online, cyber insurance protects against the risk of data breaches and cyberattacks. Other types include flood insurance for businesses in flood-prone areas and business interruption insurance, which helps maintain operations during unforeseen events like natural disasters.

Understanding the Specific Needs of Your Business Insurance

Different businesses have different insurance needs based on their industry, size, and risks. For example, a sole proprietorship insurance package may look different from insurance for LLC. If you run a restaurant, you’ll need liability coverage for foodborne illnesses or accidents on-site. A tech startup might need cyber insurance to protect sensitive customer data from hacking incidents.

Understanding your specific business risks is key to finding the right coverage. Assess the potential threats to your business and tailor your insurance policy to cover those risks. If you’re in construction, for instance, workers’ compensation and property damage protection would be essential due to the nature of the work.

How Business Insurance Protects Your Assets and Employees

The primary goal of business insurance is to protect your assets and employees. If your business experiences a fire or break-in, property insurance will cover the damage and help you replace your lost equipment or inventory. Similarly, workers’ compensation insurance provides compensation for employees injured on the job, ensuring they get the medical attention they need without bankrupting your business.

For example, a bakery could face significant financial loss if it doesn’t have insurance to cover damage to its ovens or inventory in the case of a fire. With business interruption insurance, the business can continue paying its bills while it recovers from the disaster, ensuring that operations don’t halt for too long.

The Legal Aspects: Is Business Insurance Required by Law?

In many cases, business insurance is required by law. For example, workers’ compensation is mandatory in most states for businesses that employ workers. Failing to meet these legal requirements can lead to fines, legal battles, and even the shutdown of your business. If you drive company vehicles, commercial auto insurance may also be a legal requirement.

Additionally, some industries have strict insurance requirements to protect against risks specific to their operations. For instance, construction companies must have contract insurance to cover accidents on the job site. It’s crucial to consult an insurance agent to ensure that your business is compliant with local regulations.

The Cost of Business Insurance: What to Expect

The cost of business insurance premiums depends on a variety of factors. These include the size of your business, the industry you’re in, the number of employees you have, and the type of coverage you need. For example, a small business might pay lower premiums for small business coverage, while larger businesses with more employees will pay higher premiums for more comprehensive coverage.

To get the best insurance quote, it’s important to shop around and compare different policies. Insurance premiums can be costly, but having the right protection can save your business from devastating financial losses. Remember, investing in insurance for business owners now can prevent larger expenses down the road.

How to Choose the Right Business Insurance Coverage

Choosing the right insurance coverage is a vital decision for every business owner. Start by assessing the business risks you face. Once you identify potential risks, look for coverage that will specifically protect you against those threats. For example, a business in a flood-prone area will need flood insurance to protect its assets. Similarly, if you store sensitive customer data, cyber insurance is a must.

Consulting with an insurance agent can help you navigate the different insurance types available. They can offer guidance on bundling policies into a Business Owner’s Policy (BOP), which can save money while ensuring you have the right coverage.

The Benefits of Business Insurance Beyond Coverage

While insurance for business owners is crucial for protection against lawsuits and disasters, it offers more than just financial safety. Having the right coverage can build your business reputation. Clients are more likely to trust a business that is insured. Additionally, insurance benefits can help attract and retain employees. Offering employee benefits like health coverage or disability insurance makes your business more appealing to top talent.

Business insurance also helps with risk management. It provides a framework for identifying and mitigating potential risks, allowing your business to operate more efficiently and with less fear of catastrophic loss.

Additional Business Insurance Options You Might Need

Depending on your business, there are several additional types of insurance that might be necessary. If your company uses vehicles for delivery or transportation, commercial auto insurance is a must. If you’re involved in the manufacturing or retail industry, product liability insurance protects against claims of injury or damage caused by your products.

Additionally, management liability insurance is essential for protecting your company’s executives from legal risks related to their roles. Tax ID number compliance is also crucial, as some businesses need sole proprietorship liability or LLC insurance for legal protection against any potential claims.

Conclusion

Running a business can be rewarding, but the risks are significant. Business insurance provides legal protection, helps manage risks, and ensures that your business can weather unexpected storms. While the cost of insurance premiums might seem daunting, the protection it offers makes it an essential investment. Whether you’re a small business owner or a large corporation, finding the right coverage is key to ensuring the longevity and success of your business.

FAQS

Do you really need business insurance?

Yes, business insurance is essential to protect your company from financial risks and unexpected liabilities.

What are the benefits of business insurance?

Business insurance provides financial protection, helping to cover losses from property damage, lawsuits, or employee injuries.

Is insurance a good business to be in?

Yes, insurance can be a profitable business, offering long-term growth potential and stability through consistent demand.

How much is business insurance per month?

The cost of business insurance varies based on factors like the type of coverage and the size of the business, typically ranging from $50 to $1,000 per month.

What are 5 disadvantages of insurance?

High premiums, complex policies, exclusions of certain risks, delayed claims processing, and potential for inadequate coverage are common drawbacks.

Is insurance a good or bad thing?

Insurance is generally a good thing, as it provides financial security and peace of mind, although it may come with costs and complexities.

Welcome! I’m Gourav Bisht, a dedicated deep researcher specializing in loans and insurance. With extensive knowledge and continuous research in these fields, I strive to provide accurate and valuable insights to help you make informed decisions.