A personal loan could usually be a simple option when financial needs arise. Whether to pay for house improvements, handle a medical emergency, or combine debt, it offers access to money without requiring collateral like a property or car. Choosing whether to seek a personal loan from a bank is not always easy, though. Analyzing elements, including loan terms, financial situation, and interest rates, helps you effectively measure the benefits and disadvantages.

In this blog, we will discuss a personal loan, how it operates, and when it may be the perfect time for you. We will also discuss its advantages and disadvantages, the factors when it makes sense, and how to ensure you get the best pricing.

What Is a Personal Loan?

Since most personal loans are unsecured, you are protected from having to provide any collateral—that is, property. Unlike a mortgage or auto loan, which are guaranteed by your property, personal loans depend on your creditworthiness, income, and job status. Examining these factors helps the lender or bank decide your loan eligibility and the interest rate you would be approved for.

One of the key advantages of a personal loan is its flexibility. Money is one of the adaptable financial tools available for multiple purposes. Typical personal loan applications include:

- Debt Consolidation: If you have multiple high-interest debts, such as credit card balances, a personal loan can help you consolidate them into one lower-interest payment.

- Home Improvement: Whether remodelling your kitchen, adding a new bathroom, or making energy-efficient upgrades, a personal loan can provide the necessary funds.

- Medical Emergencies: Medical bills can quickly pile up, and a personal loan might help you cover unexpected healthcare expenses.

- Major Life Events: Weddings, family vacations, or other significant events can be costly, and a personal loan may give you the financial flexibility you need.

Personal loans can be a great tool when times are limited, but it’s essential to understand your situation and ensure the loan fits your budget and objectives.

Advantages of Getting a Personal Loan from a Bank

No Collateral Required:

One of the main benefits of a personal loan is that it is usually unsecured, which means you don’t need to give any assets like your house or vehicle as collateral. If you do not have assets to put up or want to avoid the risk of losing them in the event of financial difficulties, this might be relieving. It’s a less demanding choice for borrowing as the loan depends on your creditworthiness and income; you’re not risking personal assets here.

Quick Access to Funds:

Depending on your eligibility and the lender’s policies, banks and online lenders can quickly—sometimes within only 24 hours—disburse personal loan money. Because of their quickness, personal loans are beneficial in difficult times, including medical bills, essential house maintenance, or unplanned vacations. A personal loan can give you the financial boost you need without long delays, whether your budget is limited or you are organizing an event that calls for quick finance.

Lower Interest Rates Compared to Credit Cards:

When you borrow using credit cards, the interest rates can rapidly spiral out of control and usually run above 20%. Conversely, personal loans usually have far lower interest rates; as of May 2025, they typically range from 11% to 12%. This makes borrowing a more affordable choice, particularly if you have to pay off current high-interest debt or finance a greater quantity. Throughout the loan, the variations in interest rates can significantly lower the overall amount you pay back, saving you money over time.

Fixed Interest Rates and Predictable Payments:

Personal loans also have the interesting advantage of usually including predetermined payback terms and fixed interest rates. Your monthly payments will be constant during the loan, helping you better organize and arrange your money. Predictable payments provide financial stability and peace of mind by relieving you of concerns about changing rates or unanticipated rises in your monthly responsibilities.

Debt Consolidation:

A personal loan can be an excellent debt consolidation solution for people juggling several high-interest debts—such as credit card balances or payday loans. Eliminating a personal loan to pay off these obligations may help you combine them into one monthly payment, possibly with reduced interest rates. This streamlines your financial management and enables you to pay off debt faster and with less financial pressure by saving on interest expenses.

Improving Credit Score:

Another advantage of getting a personal loan is the possibility of a better credit score. Making regular loan payments demonstrates to creditors that you can responsibly handle credit. Moreover, paying off high-interest credit card debt with a personal loan will help you better manage your credit—a significant determinant of credit score computation. Regular, on-time payments over time will help your credit score improve, thereby increasing your appeal to prospective credit or loan applicants.

Flexible Use:

Personal loans offer incredible freedom in the use of the money. Unlike loans set aside for specified uses (such as mortgages or auto loans), personal loans can be used for nearly anything. A personal loan allows you the flexibility to use the money as you see fit, whether your plans involve funding home improvements, a family vacation, a wedding, or even a medical operation. Because of its adaptability, personal loans appeal to many financial demands.

For many, personal loans from banks are a convincing choice because of these benefits, particularly if you’re looking for quick access to money, the chance to consolidate debt, or a more reasonably priced means to borrow money. Still, weighing your financial condition and ensuring a personal loan fits your long-term objectives is essential.

Disadvantages and Risks of Getting a Personal Loan from a Bank

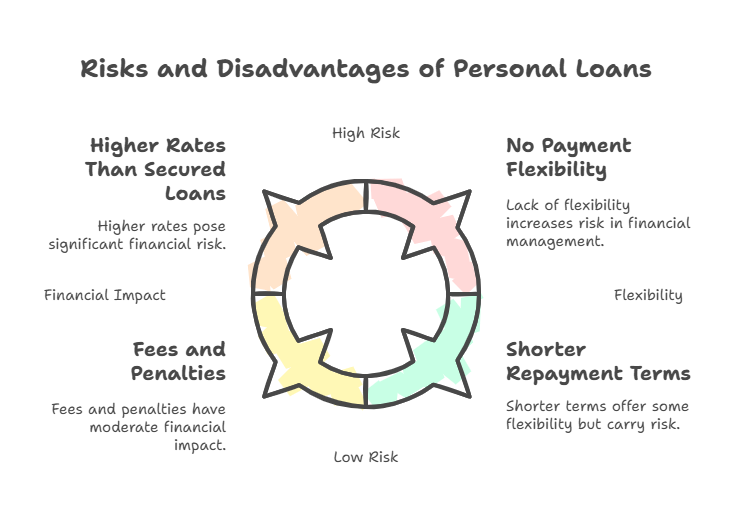

Although personal loans might be useful in some cases, they also carry inherent risks and drawbacks. Before deciding to borrow, one should seriously consider these considerations.

Higher Rates Than Secured Loans:

Generally unsecured, personal loans do not call for collateral. This makes them accessible but can also make them more costly than secured loans—such as vehicle or home equity loans. Secured loans usually include lower interest rates because an asset backs them—your house or car—which lowers the lender’s risk. Although you might still obtain reasonable rates on a personal loan if you have strong credit, the APR will typically be higher than for secured loans.

Fees and Penalties:

Different fees charged by banks and lenders can soon mount up. Usually, 1-12% of the loan amount, origination fees—charges for loan processing—are included among standard fees. Furthermore, some loans include prepayment penalties, which can be expensive should you try to pay off the loan early. Another factor is late payment penalties, as missing a payment could cause additional fees and potentially harm your credit score. Any loan agreement’s fine print should be carefully read to grasp the possible expenses fully.

Shorter Repayment Terms:

Personal loans typically have shorter terms than secured loans, ranging from 1 to 7 years. This entails higher monthly payments, although it allows you to pay off the debt faster. Shorter terms can be a double-edged sword; they help you manage the loan over time, but if the monthly payments are too high, they will strain your budget. To prevent financial hardship, make sure the monthly payment fits reasonably within your budget.

No Payment Flexibility:

One of the negatives of personal loans is typically set payments. Fixed payments could be helpful for budgeting, but if your income is erratic, they could cause problems. For example, if you lose your job or experience a financial setback, a strict payback plan could make handling your money more difficult. Unlike credit cards or lines of credit, personal loans lack the flexibility that allows you to skip or cut payments in hard times.

Potential for Increased Debt:

While paying off a personal loan can be a helpful tool for debt consolidation, you might find yourself in worse financial shape if you keep adding debt while still paying off the loan. For instance, you could worsen your debt if you repay credit card debt using a personal loan and then continue using credit cards. Good financial habits are crucial to breaking free from the pattern of borrowing more than one can afford to pay off.

Impact on Credit Score:

Your credit score may suffer significantly if you fail on a personal loan or miss payments. Missed payments reported by the lender will be noted on your record for up to seven years by the credit bureaus. A lower credit score can make it more challenging to qualify for loans or credit in the future and might cause future borrowing to cost more in interest. Only get a personal loan if you can pay it back on schedule.

When Is a Personal Loan Worth It?

Making wise financial decisions depends on knowing when a personal loan fits your situation. Although a personal loan offers numerous advantages, there are situations when it might not be the ideal choice.

When to Consider:

- Needing quick funds for specific purposes: A personal loan can offer a fast and effective solution if you have an emergency or need funds for a particular purpose, like home repairs or medical expenses.

- Consolidating high-interest debt for a lower rate: If you have multiple high-interest debts, such as credit card balances, a personal loan can help consolidate them into one manageable payment, often with a lower interest rate.

- No collateral for secured loans: If you don’t have collateral (like a home or car) to secure a loan, an unsecured personal loan can be a good alternative.

- Having a good credit score for favourable rates: If you have a strong credit score, you will likely qualify for a lower interest rate, making a personal loan more affordable.

- Monthly payments fit within your budget: If the loan payments comfortably fit your monthly budget and you’re confident in your ability to repay it, a personal loan could be a sensible choice.

When It’s Less Advisable:

- Access to cheaper credit options like home equity loans: If you have a home and can access a home equity loan, which typically offers lower interest rates and longer repayment terms, it may be a better option than a personal loan.

- Using the loan for non-essential expenses: Personal loans are generally best for essential expenses like debt consolidation or emergency expenses. Using a loan for discretionary spending (like a vacation or luxury purchases) can lead to unnecessary debt.

- Struggling with fixed monthly payments: If you have an unpredictable income or struggle to commit to fixed costs, a personal loan may not be the best option, as the rigid repayment schedule could strain your budget.

- Loans with high fees and interest compared to alternatives: If the fees and interest rates on the personal loan are high, and alternatives (like credit cards or a home equity loan) offer better terms, it may be worth considering other options to avoid paying more interest.

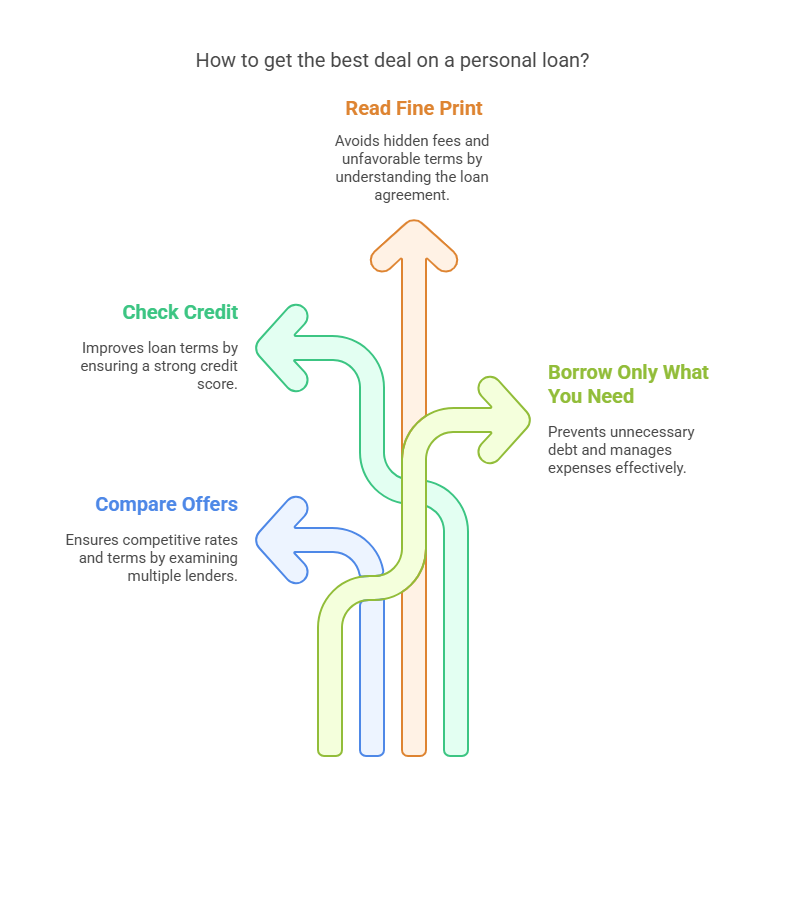

How to Get the Best Deal on Personal Loan

Compare Offers:

Shopping around is one of the most crucial phases in considering a personal loan. Comparing rates, fees, and repayment options will help you identify the best deal, as not all banks and lenders offer the same terms. Examining several offers ensures you obtain a competitive interest rate and advantageous terms. Long-term effects can be significantly influenced by some lenders offering flexible repayment plans or waiving particular fees. Before deciding, take your time to review multiple options; this will help you save money and prevent future stress.

Check Your Credit:

Your credit score greatly influences the terms of your loan. Generally, a better credit score results in lower interest rates, as lenders view you as a less risky borrower. Your credit report must be current and accurate before applying for a loan. If your credit score is strong, you may be eligible for better terms and rates, significantly reducing the total loan cost. Conversely, if your credit score is less than ideal, consider improving it before applying or seeking lenders specializing in loans for individuals with less-than-perfect credit.

Read the Fine Print:

Always review the fine print of any personal loan agreement before signing. Understanding the fees, penalties, and repayment terms that could affect the overall loan cost is vital. Many banks impose prepayment fees, late payment penalties, or origination fees—many of which can mount quickly. Also, understand whether the interest rate is fixed or variable. However, some loans seem like a good bargain; hidden fees and unfavourable clauses can make them expensive over time. Spend time thoroughly reading all terms and conditions; if something seems unclear, don’t hesitate to ask questions.

Borrow Only What You Need:

Exceptionally, if the loan amount is granted based on your creditworthiness, it can be tempting to borrow more than you need. However, borrowing more than necessary could lead to unnecessary debt and larger monthly expenses. Only borrow what you need to achieve your financial goals. This simplifies debt management and helps you stay on top of payments, preventing excessive interest. Remember that personal loans are a tool to help you advance financially, not a means of financing unnecessary expenses or lifestyle changes.

Top 5 Best personal Loan banks

| Bank Name | Personal Loan Features | Interest Rates | Loan Terms |

|---|---|---|---|

| Wells Fargo | Unsecured personal loans, flexible loan amounts, and repayment terms | 5.74% – 24.49% | 12 to 60 months |

| SoFi | Fixed-rate loans, no fees, quick funding, and multiple payment options | 6.99% – 23.43% | 36 to 84 months |

| Marcus by Goldman Sachs | No fees, flexible terms, and fixed interest rates | 6.99% – 24.99% | 36 to 72 months |

| Discover | Unsecured loans, no origination fees, and competitive rates | 6.99% – 24.99% | 36 to 84 months |

| LightStream | Low-interest personal loans for good credit borrowers | 5.73% – 19.99% | 24 to 144 months |

Conclusion:

Borrowing a personal loan from a bank is a good strategy for managing financial conditions, especially for debt consolidation or significant debt loads. Personal loans offer a workable solution if you need quick money without collateral. However, balancing the benefits and drawbacks is essential to ensure the loan conditions align with your budget. Shopping around for the best offers, reviewing your credit, reading the fine print, and borrowing only what you need will help you make an informed choice and secure a loan that suits your needs.

Remember, even though personal loans might provide flexibility and lower interest rates than credit cards, it is crucial to fully understand all terms before committing. Always ensure your repayments align with your financial plans to avoid additional financial stress.

Welcome! I’m Gourav Bisht, a dedicated deep researcher specializing in loans and insurance. With extensive knowledge and continuous research in these fields, I strive to provide accurate and valuable insights to help you make informed decisions.